Boerse Stuttgart Digital Custody

Fiduciary custody with the highest security standards Are you interested in leveraging the potential of digital assets? We offer our clients top-level security and reliability in the custody of cryptocurrencies and digital assets.

YOUR SECURE CUSTODY

Custody for Cryptocurrencies and Digital Assets

YOUR SECURE CUSTODY

We provide fiduciary custody that adheres to the highest security standards.

MICAR LICENSED CUSTODY

Custody of Cryptocurrencies

MICAR LICENSED CUSTODY

We store your cryptocurrencies and digital assets securely and reliably. Boerse Stuttgart Digital Custody GmbH is MiCAR licensed and supervised by the Federal Financial Supervisory Authority (BaFin). Additionally, our information security management system is certified according to ISO 27001.

Currently, you can store ten cryptocurrencies with Boerse Stuttgart Digital Custody: ADA (Cardano), BCH (Bitcoin Cash), BTC (Bitcoin), ETH (Ethereum), DOT (Polkadot), LINK (Chainlink), LTC (Litecoin), SOL (Solana), UNI (Uniswap), and XRP (Ripple). Cryptocurrencies custodied by Boerse Stuttgart Digital Custody are comprehensively insured through a partnership with Munich RE, covering risks like theft or hacking.

PASSIVE INCOME SOURCE

Secure staking solution—made in Germany

PASSIVE INCOME SOURCE

Interested in storing your cryptocurrencies, such as Ether, with Boerse Stuttgart Digital Custody? As an institutional investor, seize the opportunity to generate extra income through staking. To achieve staking at the highest levels of security and quality, Boerse Stuttgart Digital collaborates with the established German staking provider, Staking Facilities. Additionally, we’ve developed staking insurance in cooperation with one of the world's largest insurance providers, Munich Re Group, which covers slashing risks.

A CUSTODY SOLUTION FOR MANY USE CASES

Boerse Stuttgart Digital Custody Use Cases

A CUSTODY SOLUTION FOR MANY USE CASES

Family Offices

Are you looking to enable your clients to invest in cryptocurrencies? Expand your family office’s portfolio by integrating Bitcoin into your asset management, or by enabling your clients to invest in Bitcoin and other cryptocurrencies through you—we operate discreetly in the background.

Banks

We manage the custody of cryptocurrencies for your clients while remaining behind the scenes. Moreover, you can use Boerse Stuttgart Digital Custody as a secondary custodian, perhaps as part of your Business Continuity Management or for risk diversification. We also securely store your cryptocurrencies, such as Ether, which may be used for paying gas fees.

Brokers

Looking to offer your clients custody of digital assets? Expand your services with us. We manage custody for your clients while staying in the background. Is your customer base growing? Our custody solution is ready to scale with you.

Authorities

Are you increasingly encountering cryptocurrencies like Bitcoin? As part of the Boerse Stuttgart Group, with over 160 years of experience in the capital market, we offer a regulated and secure custody solution for cryptocurrencies, working with a reliable partner to facilitate deposits and withdrawals.

Companies

Are you involved with Web 3.0? Do cryptocurrencies play a role in your risk management strategy? Regardless, you can securely store your cryptocurrencies with Boerse Stuttgart Digital Custody, your licensed partner.

Investment Management Companies

Are you interested in incorporating cryptocurrencies like Bitcoin into your products, such as special funds, or in leveraging the potential of launching a physically backed Ether ETP? Expand and diversify your offerings related to digital assets. We provide a secure and regulated custody solution and interfaces to, for instance, authorized participants.

10 REASONS TO CHOOSE BOERSE STUTTGART DIGITAL CUSTODY

What Advantages Does Our Service Offer?

10 REASONS TO CHOOSE BOERSE STUTTGART DIGITAL CUSTODY

01

Highest Security

Boerse Stuttgart Digital's custody solution provides the highest level of security. It’s reinforced by appropriate certifications, audited processes, cutting-edge technology, and a cryptocurrency custody license. Additionally, a portion of the cryptocurrencies we custody is insured by Munich Re Group, underscoring our commitment to security.

02

Quick Availability

With over five years of experience, Boerse Stuttgart Digital Custody has provided secure and reliable custodianship for the digital assets of both private and institutional clients. Our multi-tiered custody system, equipped with automatic liquidity management, ensures the high availability of your digital assets, allowing swift access anytime while maintaining rigorous security.

03

Experienced Compliance

The Anti Financial Crime and Compliance department of the Boerse Stuttgart Group brings years of experience in meeting regulatory requirements. Benefit from our established regulatory processes, where our dedicated team utilizes streamlined and effective methods for transaction screening, supported by leading blockchain analysis providers.

04

High Connectivity

Are you looking to broaden your product offerings and integrate additional services? You can easily enhance your custody solution with other services from Boerse Stuttgart Digital at any time.

05

Quick Setup

Interested in investing in cryptocurrencies and need a secure custody solution? Boerse Stuttgart Digital Custody’s setup process is swift and straightforward, allowing you to quickly capitalize on the potential of digital assets for your business.

06

Five Years of Market Experience

For over five years, Boerse Stuttgart Digital Custody has been in operation, securely managing cryptocurrencies valued at over two billion euros (as of Q4 2023). As part of the Boerse Stuttgart Group, with over 160 years of tradition and expertise in financial markets, Boerse Stuttgart Digital is committed to the highest standards of safety, stability, and transparency, and is regulated in Germany.

07

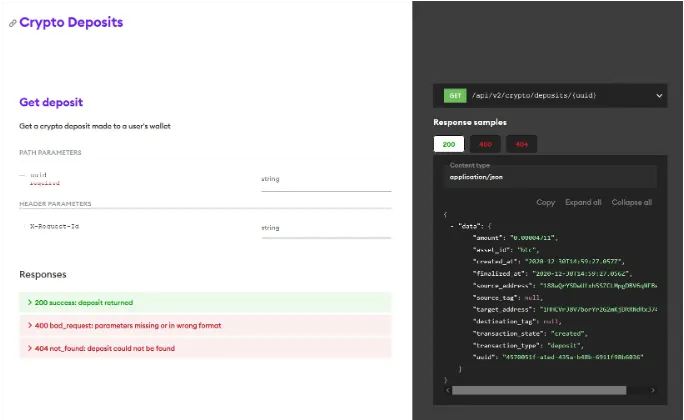

Simple Deposits & Withdrawals

Our user-friendly interface facilitates easy deposits and withdrawals for cryptocurrencies. Define clear access and approval protocols for your team, ensuring that all transactions undergo a rigorous approval process, including two-factor authentication and the four-eyes principle. Whitelisting allows you to specify wallet addresses for withdrawals, streamlining and securing the process.

08

Secure Staking Solution

Generate passive income while your cryptocurrencies are securely held in trust. Boerse Stuttgart Digital Custody relies on renowned partners who are based in Germany for its staking infrastructure: Munich Re, one of the largest and most respected insurers, and Staking Facilities, a well-known and experienced staking provider.

09

Easy Management

Our expertise in financial application development, including platforms like BISON, allows us to offer a straightforward and intuitive user interface, simplifying the management of your custodied assets. Additionally, our flexible API is designed to accommodate those who prefer to access their cryptocurrencies through their own systems.

10

Innovative Partner

As your trusted partner in the digital asset space, Boerse Stuttgart Digital prioritizes regulation and reliability in our product development. This approach ensures that you benefit from innovative solutions without compromising on security.

WHY TRUST IN CUSTODY IS SO CRUCIAL

Complete Regulation for Your Security

WHY TRUST IN CUSTODY IS SO CRUCIAL

Trust is essential in the custody of digital assets. As a MiCAR licensed cryptocurrency custodian supervised by BaFin, Boerse Stuttgart Digital Custody GmbH embodies security and credibility. As part of the long-established Boerse Stuttgart Group, we adhere to the highest standards of safety, stability, and transparency.

We regularly subject the cryptocurrencies in our custody to independent audits, reporting all findings to regulatory authorities to ensure the highest quality of our services. Operating in Germany, we benefit from the country’s strict regulatory framework and high data protection standards.

Our custody solution not only protects you from external threats but also ensures that your assets are managed by experts with deep market knowledge, technical expertise, and comprehensive information security skills.

NUMBERS, DATA, & FACTS

Boerse Stuttgart Group Is the Partner You Can Rely On

NUMBERS, DATA, & FACTS

We let our numbers speak for us:

200+

institutional clients

27

tradable cryptocurrencies

3B+

assets in custody in Euro

7

European locations

700+

international experts

30

nationalities

WOULD YOU LIKE MORE INFORMATION ABOUT OUR CRYPTO CUSTODY SOLUTION?

Your Answers to the Most Frequently Asked Questions

WOULD YOU LIKE MORE INFORMATION ABOUT OUR CRYPTO CUSTODY SOLUTION?

Your custody solution for crypto assets

5 reasons for Boerse Stuttgart Digital Custody

Your custody solution for crypto assets

✓ More than 5 years of experience in the custody of crypto assets

✓ Part of the Boerse Stuttgart Group with over 160 years of tradition

✓ Secure, regulated custody solution "made in Germany"

✓ Easy entry into the future of the financial world

✓ Fast operational readiness for your projects

Contact form

Expert advice for the custody of your crypto assets

YOUR CONTACT PERSONS

Expert advice for the custody of your crypto assets